Engaging Talent, Local Hiring and Senior Management

ITC's human resource management systems and processes are relentlessly customer-focused, competition-differentiated, performance-driven and future-capable. The Company's Human Resource Development strategy seeks to fulfil this mandate through careful selection and rigorous implementation of a wide range of programmes and interventions.

ITC's human resource management systems and processes are relentlessly customer-focused, competition-differentiated, performance-driven and future-capable.

ITC believes that its competitive capability to build future-ready businesses and create enduring value for stakeholders is enriched by a dedicated and high-quality human resource pool. Therefore, nurturing quality talent and caring for the well-being of employees are an integral part of ITC's work culture, which focuses on creating a conducive work environment that helps deliver winning performance.

The Company's policy on "Diversity and Equal Opportunity" is premised on its fundamental belief that diversity at the workplace creates an environment favourable to engagement, alignment, innovation and high performance. The Policy provides for diversity and equal opportunities to all employees across the Company, based on merit and ability. The policy also ensures a work environment that is free from any form of discrimination amongst its employees in compensation, training and employee benefits, based on caste, religion, disability, gender, sexual orientation, race, colour, ancestry, marital status or affiliation with a political, religious or union organisation or majority/minority group.

The Company's talent management strategy is focused on building a future-ready talent bank in the organisation to ensure a pipeline of high-quality managerial talent, specialists and business leaders. ITC's talent engagement approach focuses on attracting and nurturing quality talent, supported by significant investments in learning and development.

ITC's talent engagement approach focuses on attracting and nurturing quality talent, supported by significant investments in learning and development.

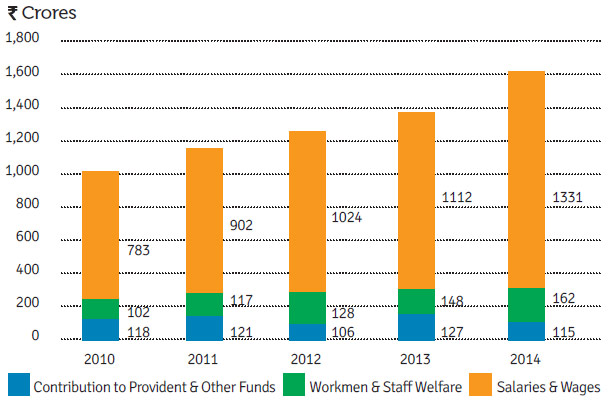

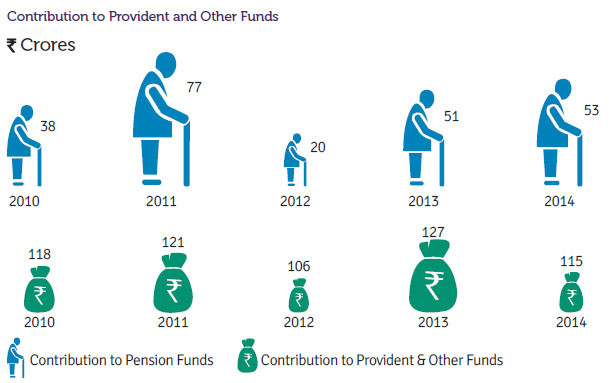

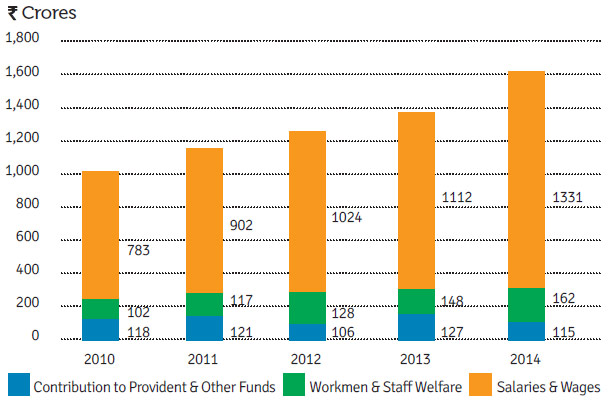

In 2013-14, the minimum wage paid to entry level workers of the Company was equal to or more than the statutory minimum wage applicable at all locations of ITC's operations. Employees' Retirement Benefit Schemes include employee pension, provident fund and gratuity, which are administered through duly constituted and approved independent trusts. Provident Fund and Family Pension contributions in respect of unionised staff, as required by applicable statutes, are deposited with the Government in a timely manner.

Pension plans and other applicable employee benefits obligations are determined and funded in accordance with independent actuarial valuation. Expected rate of return on plan assets is based on the current portfolio of assets, investment strategy and market scenario.

ITC has diversified plan assets in order to protect capital and optimise returns within acceptable risk parameters. In addition, funds are consistently sustained to meet requisite superannuation commitments.

Corporate Social Responsibility

ITC's overarching aspiration to create significant and sustainable societal value is inspired by a vision to subserve a larger national purpose and abide by the strong value of trusteeship.

ITC's overarching aspiration to create significant and sustainable societal value is inspired by a vision to subserve a larger national purpose and abide by the strong value of trusteeship. This larger commitment is manifest in ITC's CSR initiatives that include the most disadvantaged sections of society, especially in rural India, through economic empowerment based on grassroots capacity building. In the social sector, the two most important stakeholders for the Company are:

- Rural communities with whom ITC's agri-businesses have forged a long and enduring partnership through their crop development activities and the ITC e-Choupal, the world's largest unique rural digital infrastructure network that enables dissemination of valuable information relating to weather conditions, agricultural best practices, ruling market prices etc.; these households operate in rain-fed conditions in some of the most moisture-stressed regions of the country.

- Communities residing in close proximity of the Company's production units, whose full potential cannot be realised due to poor social infrastructure in the areas of education and health.

In pursuance of the Company's policy on Corporate Social Responsibility (ITC's CSR Policy detailed in the Policies & Guidelines section of this Report and in the section on Report of the Directors & Management Discussion and Analysis in the Annual Report and Accounts 2014), the thrust of the Company's CSR strategy and programmes has been focused on (a) Diversification of farming systems of rural communities by broad-basing the farm and off-farm based livelihoods portfolio of the poor, through an integrated approach that includes the development of wastelands, watersheds, agriculture and animal husbandry, and (b) Economic empowerment of women and creation of social capital in the catchment habitations of manufacturing units to enable these communities to acquire relevant and contemporary skills.

Various CSR activities in which the Company has been engaged during the current year are listed on the next page.

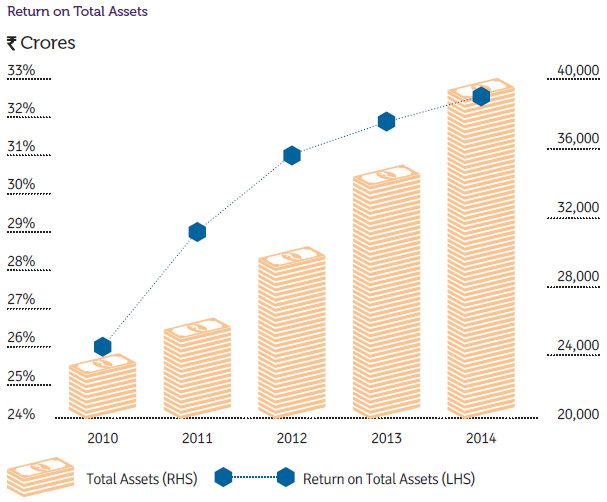

Despite the extremely challenging business environment during the year under review, ITC continued to make significant investments across its business domains, even as it has been successful in progressively generating higher returns on the assets deployed. Therefore, while the Balance Sheet size of the Company has expanded at a compound rate of 14% over the previous five years to reach ` 39,229 Crores as at 31st March, 2014, returns on assets deployed have increased from about 26% to about 32% during the same period.

Despite the extremely challenging business environment during the year under review, ITC continued to make significant investments across its business domains, even as it has been successful in progressively generating higher returns on the assets deployed. Therefore, while the Balance Sheet size of the Company has expanded at a compound rate of 14% over the previous five years to reach ` 39,229 Crores as at 31st March, 2014, returns on assets deployed have increased from about 26% to about 32% during the same period.

ITC is one of India's most admired and valuable corporations and has, over the last 18 years, consistently featured amongst the top 10 private sector companies in terms of market capitalisation & profits. The Company's shares are amongst the most influential stocks in the Indian equity market.

ITC is one of India's most admired and valuable corporations and has, over the last 18 years, consistently featured amongst the top 10 private sector companies in terms of market capitalisation & profits. The Company's shares are amongst the most influential stocks in the Indian equity market.

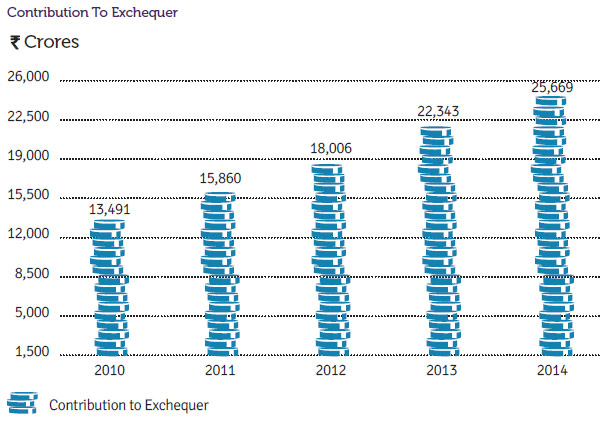

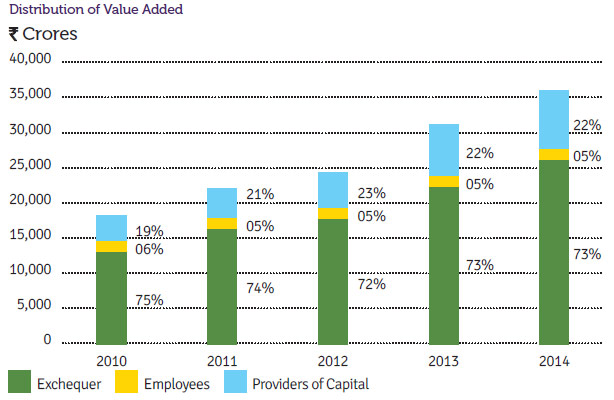

The Company's contribution accounts for about 7.7% of the total excise revenue of the Government of India. In the area of income tax, the Company is the highest tax payer in eastern India and among the top tax payers nationally in the private sector.

The Company's contribution accounts for about 7.7% of the total excise revenue of the Government of India. In the area of income tax, the Company is the highest tax payer in eastern India and among the top tax payers nationally in the private sector.