Non-cigarette business poised for a bigger innings at ITC - The Economic Times

October 25, 2011

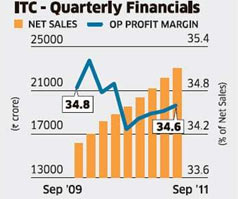

The faith of ITC shareholders in the multi-business conglomerate has been consistently paying off since the past several quarters. The company has been consistently logging 15%-plus growth in sales and a more than 20% jump in net profit, quarter after quarter since September 2009. Its performance in the latest quarter ended September 2011 is yet another reason for the investors to cheer.

Beating market expectations, ITC posted a 17.5% rise in net sales and a 19% jump in operating profit. Despite input cost inflation and pricing pressures due to intense competition, the company managed to post a marginal 20-bps increase in operating profit margin to 37.1%.

Rationalisation of other expenses (which include marketing and promotion) is one of the areas where the company has managed to cut costs. Other expenses, as a proportion of net sales, grew 21.4% compared to a year ago growth of 23.1%. ITC has attributed the growth in sales to branded packaged foods, education & stationery products, lifestyle retailing, agri and cigarettes businesses.

ITC's third largest business segment - the non-cigarette FMCG business -has been growing the fastest in the September quarter. Contributing nearly one-fifth to ITC's net revenues, the segment has been growing at a faster pace quarter after quarter. In fact, with each passing quarter, ITC has steadily managed to cut down the losses generated by the segment. At this pace, the segment may break even sooner than later.

The cigarette business has registered both volume and value growth. Following the imposition of VAT in certain states, ITC has raised the prices of some of its cigarettes. This has boosted realisations from the segment. While the cigarettes business contributes the lion's share, or 77% to the total segmental earnings, the non-cigarette earnings are increasing at a faster rate than those of the cigarettes.

ITC's stock is valued at 31 times its earnings of trailing 12 months. ITC''s stock price is hovering around its all-time high level of 211 hit in July 2011. ITC is one of the few diversified conglomerates that is doing well across all its unrelated segments.

It enjoys leadership position in cigarettes, paperboards and agri business and owns the second-largest hotel chain. Its stock valuations, despite being high, are nevertheless justified. Investors will benefit from being part of the process wherein the company gradually shifts its earnings reliance from cigarette to non-cigarette businesses.